Yo! ✌️ I’m Brett! I am a Product Manager and former Cognitive Science researcher. Social Studies is a semi-weekly newsletter for people building great products for humans. It includes recaps of what happened on Tech Twitter every week plus deep analysis using frameworks from Psychology, Economics, and the other Social Sciences.

✨TLDR

☄️ Destabilizing events increase biodiversity

There’s a direct relationship between biodiversity and resource abundance in a biological ecosystem. Specifically, when an ecosystem has a sudden expansion in resources, the volume and range of species represented in the ecosystem also expands.

If you ever left food out for too long and saw rats, ants and other creatures appear out of nowhere soon after, you understand this concept.

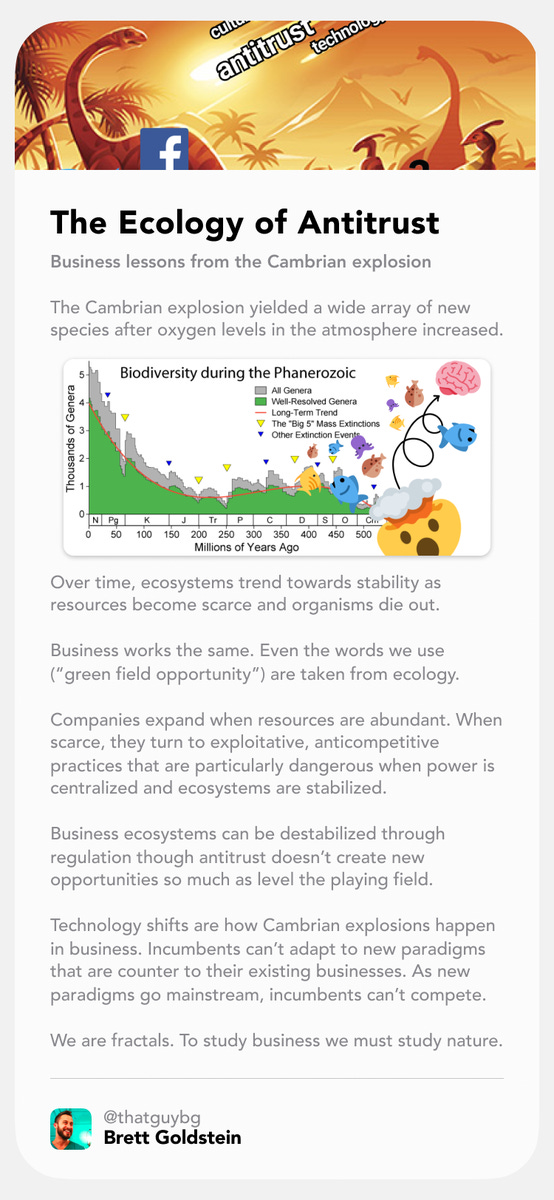

One of the best examples is the Cambrian explosion, which gave birth to a wide range of multicellular organisms (our direct ancestors) 500M years ago. Scientists believe it came about due to a sudden increase in oxygen levels in the atmosphere.

A few hundred million years later however, the number of species declined by 75%. All ecosystems end up trending towards less biodiversity over time.

As the number of organisms increases, so does competition for resources. As Darwin would say, only the fittest survive. Less differentiated and adaptive organisms die out until the ecosystem stabilizes.

As this happens, competition decreases, evolution slows and biodiversity declines.

Ecosystems are incredibly complex, but Newton’s Law of Motion can be roughly adapted:

An ecosystem that has stabilized cannot be changed unless acted upon by an outside force.

Whether it’s changing oxygen levels in the atmosphere, a mega-comet hitting Earth, or the introduction of an invasive species, the point remains. Major destabilizing events are required for biodiversity to flourish and new species to emerge.

Here’s the punchline: Business ecosystems work the same way.

🏢 Business ecosystems behave like biological ecosystems

Just like biological ecosystems, business ecosystems trend towards stability.

A business competing over the same resources (in the form of target customers and use cases) as another less successful business usually ends up killing it off or forcing it to adapt.

The ride sharing ecosystem is a great example here. Sidecar (along with a long list of other ride sharing companies) shut down after failing to compete with Lyft and Uber (who literally starved it for investment resources). Today, Uber and Lyft are the only options in most US cities.

The availability of resources to fund less differentiated competitors in a market is directly impacted by investors’ belief in how stable the ecosystem is. Today very few believe a startup could unseat Uber or Lyft in ride sharing, but there’s plenty of green field opportunity in the passion economy space. We would say we’re in a “ride sharing winter” (like “AI winter”) to describe the lack of resources available to fund companies in the space.

It’s no mistake the very words we use (green field opportunity, AI winter, etc) employ metaphor to make us conceptualize businesses as animals and business ecosystems as biological ecosystems. It’s because they are.

Like the natural world, destabilizing events can increase diversity and evolution in the business world.

There are two major types of destabilizing events:

🚫Regulation - Microsoft’s antitrust case, the Tik Tok ban, health warnings on cigarette packs

💻 Technology shifts - The iPhone, AWS, social media

🚫 Regulation destabilizes ecosystems

Regulation is appealing because it is the only way to proactively intervene in an ecosystem. All other destabilizing events are decentralized, unpredictable, and passive.

It also appeals to the psychology of the disenfranchised. Very generally, groups at the bottom of the food chain seek disruption while groups at the top seek stability.

Working class people wouldn’t be as progressive if they were wealthy.

Europe wouldn’t push GDPR if it had dominant tech companies and cutting edge AI research.

What’s fascinating is that the disenfranchised invariably trend towards corruption once the power is passed on to them.

Power tends to corrupt; absolute power corrupts absolutely. - Lord Acton

🤼♀️ Leveling the playing field

Early on, when a company is printing money and the market is expanding, they branch into new high risk areas without much of a care about precision or competition.

But as markets (and adjacent markets) become saturated and previously unencumbered growth slows, businesses turn to exploitative measures to fulfill their “embedded growth obligations.”

Nasty zero-sum games emerge where cost cutting measures and shifty business practices become the norm. Depending on how constrained resources are, these exploitative behaviors can get really ugly.

This is compounded by the fact that whether they verbalize it or not, most companies eventually trend towards monopoly. Both organisms and companies seek more resources and more predictability in acquiring resources - this naturally lends itself to monopolistic behavior over time.

Peter Theil’s famous startup advice “competition is for losers” suggests that not only is monopoly the natural evolution for any business, but it is the desired end state.

Monopolies aren’t always abusive. In the same way, it’s possible to have a bear as a pet. But as mentioned, when resources are constrained, businesses and bears behave badly.

Consumers suffer, competition is knee-capped. Eventually innovation slows and societal learned helplessness emerges where disenfranchised entrepreneurs building competing products actually become depressed.

Antitrust law is one of the most effective ways to evade these problems by breaking up large companies into smaller competing companies.

While it doesn’t necessarily change the amount of resources in an ecosystem since the new companies end up going after the same finite business opportunities, it does level the playing field.

🦁 Poking a hole in the food chain

The most recent ban of Tik Tok in India and potential ban in the US presents another kind of regulation-driven ecosystem disruption where one part of the food chain is just completely wiped out.

There’s an old episode of The Future Is Wild showing what would happen if humans suddenly left the planet. Long story short, wildly different species emerge and squids take humans’ place as most powerful animals on Earth.

That is what is playing out in India right now -

a Cambrian explosion in social media apps.

A ton of new apps are emerging, but the ones that have the best shot at seizing the opportunity are underdogs (like Triller and Dubsmash) or adjacencies (like Instagram). It makes sense - these apps require the least amount of adaptation to fulfill the same function that Tik Tok did.

There’s an interesting parallel to neuroplasticity. When a patient gets a limb amputated, the part of the cortex responsible for movement and sensation for the amputated limb gets taken over by adjacent areas that control in-tact limbs.

In this case, the ecosystem in question is the brain, and the competition is between cognitive functions.

💻 Tech shifts destabilize ecosystems

Very few companies have actually been targets of antitrust regulation or flat out bans. That said, even the strongest companies eventually lose power and fade into oblivion.

The average lifespan of companies has actually been declining from around 60 years in the 1960s to around 20-30 years today.

How can this be?

Clayton Christensen’s Innovator’s Dilemma offers one of the clearest explanations - technology shifts.

Entrenched businesses often have trouble embracing disruptive technologies because

Doing so would threaten the existing business

The near-term opportunity enabled by the new technology would initially comparatively insignificant

Benedict Evans makes a great point that these technology shifts look absolutely crazy in the early days, which makes them easier to overlook by cash-printing incumbents.

Since “software is eating the world,” these technology shifts have a dramatic impact on the entire business ecosystem. The news media industry was completely upended by the shift to social media platforms and it never recovered.

One of the secondary compounding effects of technology disruption is around corporate culture. Once a business is disrupted and begins declining, it becomes harder to hire top talent. As revenue and relevance fade, so does pay and prestige. Ultimately, most companies are left with an aging workforce less able to out-work and out-innovate their younger competitors.

✨ One more thing

So far, we’ve been comparing business ecosystems and biological ecosystems. The truth is, this pattern can be applied to basically everything.

When resources are abundant, explorative behaviors are favored:

Wildly different species emerge when there’s excess oxygen in the atmosphere

New companies emerge when a new technology unlocks new business opportunities

More experimental films were produced in the heyday of the movie theater when opening day viewership was higher

Younger people with more time left in life spend time making new friends (time is a resource)

And when resources are scarce, exploitative behaviors are favored:

Fewer, more highly adapted species thrive when there is more competition for resources.

Businesses turn to cost-cutting and zero sum games when there is more competition for customers.

The film industry has turned to popular IP and sequels to ensure viewership since fewer people have been going to the theater

Older people prefer spending time with their close friends and family (versus making new friends) because they have less time in their life.

Why?

As products of the natural world, humans and anything we create reflect it.

We are fractals✨

🙏 Thanks

Happy Tuesday!